Resources for E-Commerce Business Success

Nabamita Sinha, 6 days ago

Are you looking for ways to help your business stand out for all the right reasons among a crowd of competitors?

FinTech applications are a great way to do just that. FinTech is an abbreviation for financial technology, and it generally refers to the use of technology in the delivery of financial services.

In other words, FinTech aids in making financial transactions more convenient, efficient, and secure. Today, we’ll tell you more about how your business can incorporate financial technology into its operations and how you can learn more about FinTech’s potential in FinTech courses.

There are FinTech courses available online which can help you get started on the path of learning about this growing industry.

A certificate in FinTech can open up a world of opportunities for your career. In these courses, you’ll learn about the basics of FinTech and its applications. You’ll also get an overview of the FinTech industry, including its current landscape and future prospects.

After completing a FinTech course, you’ll be able to make more informed decisions about how your business can benefit from financial technology.

In the meantime, here are six FinTech applications to consider for your business.

Customers expect to be able to bank online, and FinTech can make this possible. FinTech applications can help you develop a secure online platform for your customers to conduct transactions. This is convenient for them and helps save on costs associated with traditional brick-and-mortar banking.

You can also take advantage of FinTech’s security features when you offer online banking services. For example, you can use two-factor authentication to require customers to confirm their identity before they log into their account.

This helps protect your customers’ information and makes it less likely that their accounts will be compromised.

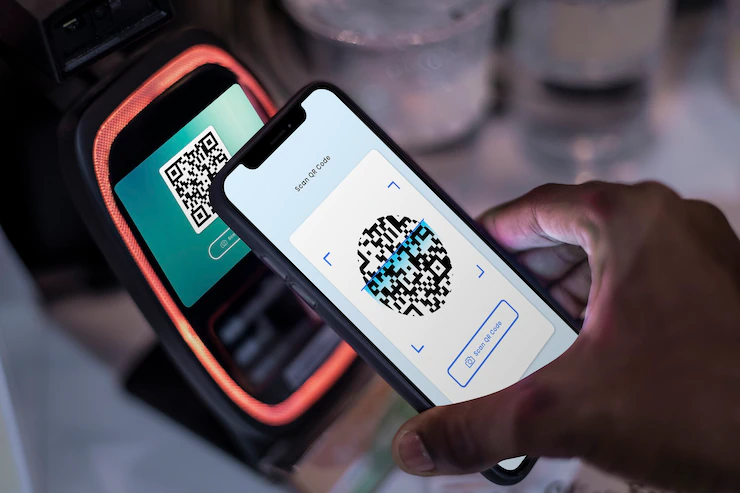

With mobile payments, customers can make transactions using their mobile devices. This is a convenient way for customers to pay, and it’s also secure. FinTech applications can help you develop a mobile payment system that meets the needs of your business.

For many modern businesses, particularly those operating online, mobile payments are a must. You’ll need to integrate a FinTech solution into your point-of-sale system to accept mobile payments.

This way, you can process transactions using your customers’ mobile devices. Not only does this help businesses make sales, but it also helps ensure customers have the means to pay if they aren’t carrying cash.

A digital wallet is a FinTech application that stores customer information securely. This information can include credit card numbers, loyalty program points, and more.

Customers can use their digital wallets to make purchases both online and in-store. This is a convenient way for customers to keep track of their information and make transactions.

Cryptocurrency is a digital or virtual currency that uses cryptography for security. FinTech applications can help you develop a system to accept cryptocurrency as payment. If you’re considering this option, it’s essential to do your research and understand the risks involved.

Cryptocurrency is a relatively new technology, and it’s still evolving. As such, there’s a lot of volatility in the market. The value of cryptocurrency can fluctuate widely, and it can be difficult to predict. For businesses, this means there’s a risk that the value of cryptocurrency could drop suddenly.

Despite these risks, cryptocurrency is becoming more mainstream, and FinTech applications are making it easier for businesses to accept it as payment.

Data analytics involves collecting, organizing, and analyzing data to gain insights. FinTech applications can help you manage and analyze data to understand your customers and their needs better.

This information can then be used to make more informed decisions about product development, marketing, and more.

There are several unique ways businesses can use data analytics.

Here are just a few examples:

As the world becomes increasingly digitized, cybersecurity also becomes increasingly important. FinTech applications can help you develop a system to protect your customer’s data from cyber threats.

There are many ways cybersecurity and FinTech can be used in your business, including data encryption, password protection, and more.

Cybersecurity is a particularly exciting area in FinTech because there’s always something new to learn. Furthermore, FinTech applications must evolve as cyber-threats evolve to stay ahead of the curve. This means there are constantly new FinTech solutions to explore, making it an exciting and ever-changing field.

FinTech applications offer a wide range of benefits for businesses. From mobile payments to data analytics, there’s a FinTech solution for almost every business need. However, when choosing the suitable FinTech applications for your business, it’s essential to do your research and select the solutions that will best meet your needs.

Undoubtedly, FinTech is a growing industry with a lot of potential for businesses. By incorporating FinTech into your operations, you can make your business more efficient and secure.

Remember, if you’re interested in learning more about FinTech, consider taking FinTech courses.

These courses can help you get started on the path of learning about this growing industry and establish your position as a FinTech professional.

Additionals

Abdul Aziz Mondol is a professional blogger who is having a colossal interest in writing blogs and other jones of calligraphies. In terms of his professional commitments, he loves to share content related to business, finance, technology, and the gaming niche.